The Build vs. Buy Decision Framework for Hotel Check-in Automation Software

In the era of hotel automation, choosing whether to build or buy a digital check-in solution is a strategic dilemma for hotel groups. This guide examines how effective self check-in implementation can cut costs, integrate with the PMS and elevate the guest experience.

While 89% of hotel CTOs claim digital transformation as their top priority, our analysis of 500 RFPs reveals that 67% still specify requirements that perpetuate manual workflows. The disconnect? They’re automating tasks instead of reimagining processes.

The hospitality front desk management software market is forecast to reach USD 3.2 billion by 2025, with a CAGR of 12.5% through 2033, primarily driven by widespread adoption of cloud-based platforms that deliver efficiency, scalability, and cost savings for all property sizes. Yet despite this market growth, hotel groups struggle with a fundamental decision: should they build custom front desk automation solutions tailored to their specific needs, or buy vendor platforms that promise faster deployment but may require operational compromises?

This decision becomes more complex when considering that multi-property rollouts of new digital front desk solutions remain challenging, primarily due to legacy system integrations, inconsistent infrastructure across properties, and the need for large-scale change management initiatives. The stakes are high—properties implementing comprehensive automation report operational cost reductions of 40% and guest satisfaction improvements of 15-20 points, but failed implementations can damage brand reputation and waste millions in technology investments.

This framework provides hotel IT leadership with a structured approach to evaluating front desk automation platforms, moving beyond feature comparisons to examine integration complexity, scalability constraints, and hidden costs that determine long-term success.

Quantifying Operational Debt in Manual Processes

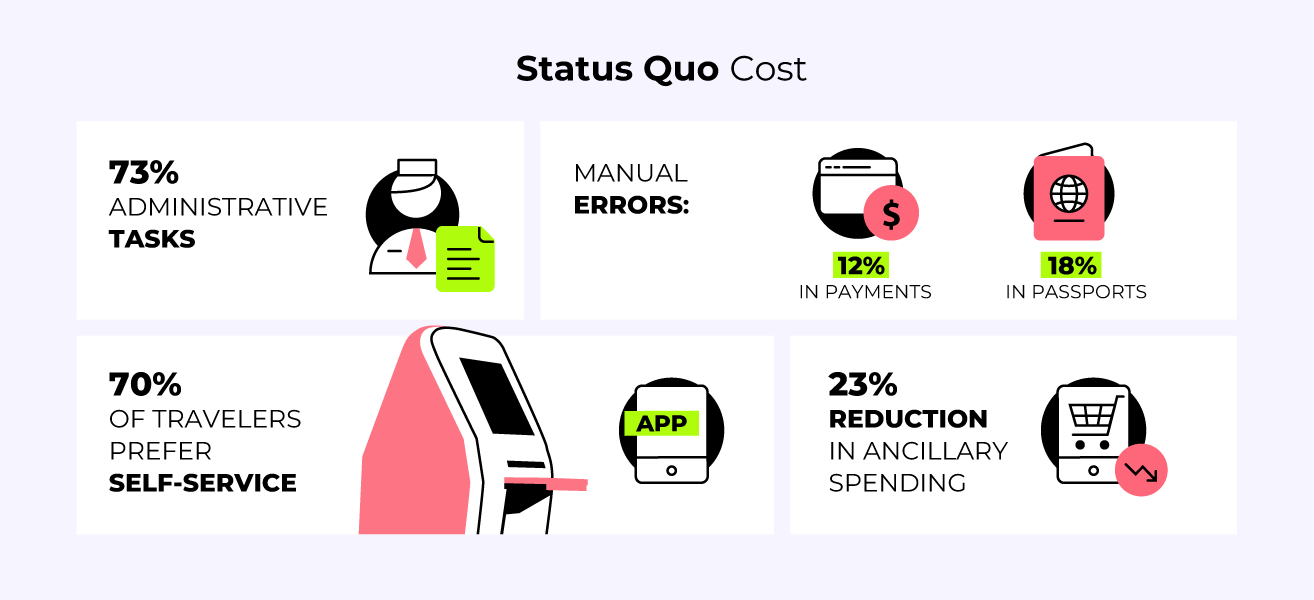

The True Cost of Status Quo

Before evaluating automation solutions, hotel groups must establish baseline metrics that quantify current operational inefficiencies. Front office workload analysis reveals that staff spend 73% of their time on administrative tasks—data entry, document scanning, payment processing—leaving minimal capacity for genuine guest engagement. This translates to 4,000+ hours annually of manual work per property that automation could eliminate.

The financial impact extends beyond labor costs. Manual payment processing generates disputes that consume 15-20 hours weekly in resolution efforts while damaging guest relationships. Front desk staff manually entering credit card information for pre-authorizations create errors in 12% of transactions, leading to failed holds, incorrect charge amounts, and disputed settlements. With PSD2’s Strong Customer Authentication requirements now enforced across Europe, hotels face increased decline rates and compliance risks when relying on manual payment processes.

Regulatory compliance presents another layer of operational debt. Manual data entry creates systematic vulnerabilities, with staff transcribing passport information making errors in 18% of entries. Spanish Law 25/2007 and similar regulations across EU markets demand real-time reporting that manual processes cannot support efficiently. A 34-property European chain recently discovered their manual processes created €800,000 in potential regulatory exposure across their portfolio.

Revenue Leakage Through Friction

Peak hour bottlenecks at hotel front desks create cascading operational failures that directly impact revenue. When check-in processes average 8-12 minutes per guest during manual operations, properties experience queue formations that correlate with 23% lower ancillary spending. Guests waiting in queues skip retail browsing, decline upsell offers, and generate negative reviews that impact future bookings.

The opportunity cost compounds when considering guest preferences. A 2025 survey of 2,000 U.S. travelers found that 70% prefer app or kiosk check-in, with Gen Z reaching 82% preference for self-service options. Hotels failing to meet these expectations lose direct booking share to competitors offering frictionless digital experiences. Leading chains like Marriott now process 67% of arrivals digitally, while boutique brands like Zoku achieve 89% automated check-ins without sacrificing personalization.

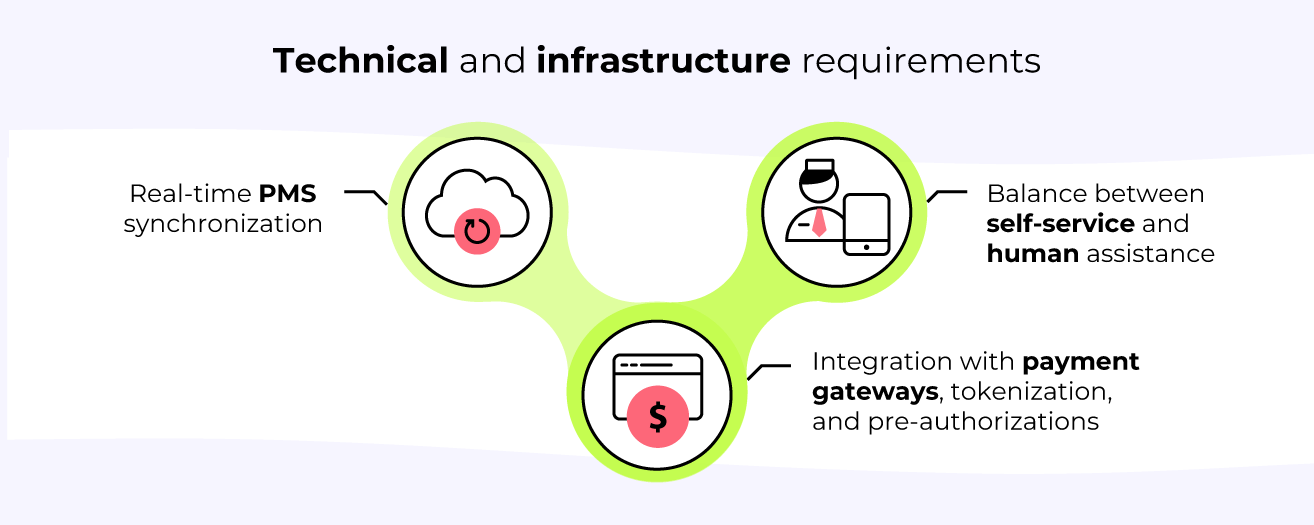

Technical Prerequisites and Dependencies

PMS Integration Complexity Assessment

The foundation of any front desk automation initiative rests on Property Management System (PMS) integration capabilities. Modern cloud-based solutions support seamless digital check-in, billing, and guest communications, but legacy on-premise systems often require extensive middleware development or complete replacement. Hotel groups must evaluate their PMS landscape across all properties to identify integration barriers before committing to build or buy decisions.

Real-time PMS synchronization eliminates delays and errors inherent in batch processing approaches. When guests complete pre-arrival check-in, the system must immediately update room assignments, validate payment methods, and trigger housekeeping notifications without manual intervention. Advanced implementations include two-way synchronization that captures guest preferences during check-in, enriching profiles for personalized service delivery.

DeskForce implementations demonstrate that successful automation requires native PMS integration supporting:

- Automated balance reconciliation

- Real-time room status updates.

- Instant archival of invoices and payment confirmations.

Properties operating multiple PMS platforms face additional complexity, requiring either standardization efforts or automation solutions capable of multi-system orchestration.

Payment Gateway Architecture Requirements

Multi-gateway payment integration has become critical for PCI/PSD2 compliance while supporting multiple geographies, currencies, and payment methods. The enforcement of PSD2/SCA has driven more hotels to adopt advanced digital payment gateways supporting multi-factor authentication and dynamic pre-authorization, balancing security with guest convenience.

Hotels must accommodate credit cards, digital wallets, virtual cards from OTAs, and emerging payment methods—all while maintaining security across jurisdictions. The technical architecture requires tokenization at every touchpoint, ensuring sensitive payment data never resides in hotel systems. This approach reduces PCI compliance costs by 60% while improving transaction success rates through intelligent routing.

Automated pre-authorization systems must handle dynamic risk scoring, calculating holds based on room type, length of stay, and guest history rather than applying blanket amounts. DeskForce’s digital payment solution demonstrates how multi-gateway support enables hotels to accept various payment methods while ensuring compliance and reducing processing complexities. Pre-authorized deposits are instantly recorded in the PMS, tracking real-time expenses and notifying guests of exceeded credit limits.

Infrastructure and Scalability Considerations

Hotel groups evaluating automation solutions must assess infrastructure requirements across their portfolio. Cloud-based platforms offer advantages in scalability and maintenance, but may face connectivity challenges in properties with limited bandwidth. On-premise solutions provide greater control but require significant IT resources for deployment and ongoing support.

Self-service kiosks are now standard or piloted in midscale and upscale urban hotels, but require physical space allocation, power infrastructure, and network connectivity. Tablet-based assisted check-in offers more flexibility, allowing front desk agents to process arrivals anywhere in the lobby without fixed infrastructure constraints. Properties must evaluate their physical layouts and guest flow patterns to determine optimal deployment models.

Scalability extends beyond technical infrastructure to operational capacity. Successful operators maintain an assisted plus self-service balance, preserving front-desk team visibility for complex service queries while letting digital platforms handle high-frequency, low-complexity tasks. This hybrid approach requires careful orchestration of digital tools and staff capabilities.

Vendor Evaluation Matrix

Core Functionality Assessment

When evaluating vendor platforms, hotel groups should prioritize solutions offering comprehensive automation across the entire guest journey rather than point solutions addressing isolated touchpoints. Core functionality must encompass:

- Pre-arrival online check-in.

- Assisted digital workflows for front desk staff

- Automated payment processing with pre-authorization management.

- Digital check-out with real-time PMS updates.

DeskForce’s approach demonstrates the importance of multi-channel activation strategies. Hotels implementing comprehensive activation —combining email, SMS, mobile apps, and booking confirmation pages— achieve 40-60% pre-arrival completion rates compared to 10-15% for single-channel approaches. Vendor solutions should support deep-linking that bypasses authentication steps for known guests while maintaining security.

Document verification capabilities have become critical differentiators. AI-powered ID validation systems scan passports and identification documents from 195+ countries, extracting data with 99.7% accuracy while detecting fraudulent documents. The verification process should complete in under 3 seconds, compared to 45-90 seconds for manual entry. Biometric guest verification and AI-powered ID validation are growing but not yet ubiquitous, with some upscale properties using facial recognition for seamless mobile check-in.

Integration and Compatibility Analysis

Vendor platforms must demonstrate proven integration with your existing technology stack. Beyond PMS compatibility, evaluate connections to:

- Customer Relationship Management (CRM) systems

- Revenue management platforms.

- Housekeeping applications, and loyalty programs.

- Payment gateways and digital keys.

Each integration point represents potential failure risk during implementation.

Payment gateway flexibility proves essential for multi-property groups operating across different markets. Solutions should support multiple gateways simultaneously, enabling properties to use regional processors while maintaining centralized reporting. Tourist tax automation capabilities become critical for European operations, with systems maintaining current tax rates and automatically calculating amounts based on guest demographics and stay duration.

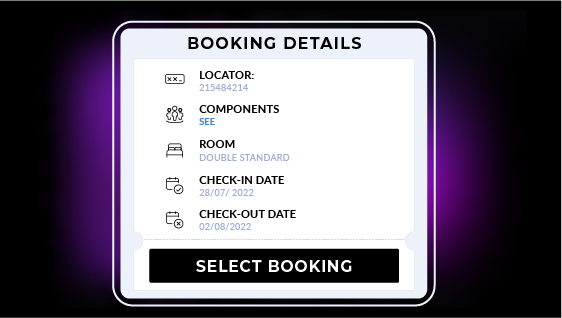

OTA and tour operator integration remains challenging, with 60-80% of bookings flowing through third-party channels. Advanced implementations identify OTA bookings in the PMS, generate unique check-in links, and deliver them through property-branded communications that establish direct guest relationships before arrival. Evaluate vendor capabilities for handling group bookings with multiple rooms, varied arrival times, and consolidated billing requirements.

Total Cost of Ownership Calculation

TCO analysis must extend beyond licensing fees to encompass implementation, training, maintenance, and opportunity costs. Initial deployment typically ranges from $200-500 per room depending on PMS complexity and integration requirements. However, hidden costs often emerge during implementation, including data migration, custom development for edge cases, and extended training periods.

Change management represents a significant but often underestimated expense. Leading hotel groups use comprehensive programs including staff training, communication campaigns, and pilot deployments to drive adoption. Properties report training costs exceeding €45,000 annually when implementing new digital workflows. Vendor solutions offering intuitive interfaces and comprehensive training resources can significantly reduce these expenses.

Ongoing operational costs include transaction fees for payment processing, support contracts, and periodic updates. Cloud-based solutions typically operate on subscription models with predictable monthly costs, while on-premise deployments require infrastructure maintenance and periodic hardware refresh cycles. Calculate five-year TCO including all direct and indirect costs to enable accurate comparison.

Build Versus Buy: Strategic Decision Criteria

When Building Makes Sense

Custom development becomes viable when hotel groups possess unique operational requirements that vendor solutions cannot accommodate. Luxury brands with highly personalized service models may require bespoke workflows that standard platforms cannot deliver. Properties with proprietary loyalty programs or complex corporate agreements might need custom integration logic that vendors cannot support.

Building internal solutions provides complete control over functionality, user experience, and data ownership. Hotel groups can iterate rapidly based on guest feedback without depending on vendor development cycles. Custom solutions also eliminate vendor lock-in risks and ongoing licensing fees, potentially reducing long-term costs for large portfolios.

However, building requires significant technical expertise and ongoing resource commitment. Development teams must understand both hospitality operations and modern software architecture. Hotel groups should realistically assess their ability to attract and retain technical talent capable of building and maintaining enterprise-grade solutions. Consider that Accor and Marriott have invested millions in proprietary platforms, with development cycles extending multiple years before achieving current adoption rates of 60-70% among loyalty members.

When Buying Delivers Value

Vendor platforms offer faster time-to-value, with typical deployments completing within 3-6 months versus 18-24 months for custom development. Established vendors bring proven integrations with major PMS platforms, payment gateways, and third-party systems. This ecosystem compatibility reduces implementation risk and accelerates deployment across multi-property portfolios.

Modern vendor solutions incorporate industry best practices derived from hundreds of implementations. Features like AI-driven predictive analytics for operational forecasting and guest upsell targeting come standard in leading platforms. Vendors also handle regulatory compliance updates, ensuring solutions remain current with evolving requirements like PSD2/SCA enforcement.

Vendor partnerships provide ongoing innovation without internal investment. As biometric verification and contactless technologies mature, vendors incorporate these capabilities into their platforms. Hotel groups benefit from continuous improvement without dedicating internal resources to research and development. Princess Cruises’ MedallionClass technology demonstrates how vendor-developed solutions can deliver at-scale guest identification and preference-driven service.

Hybrid Approaches and Phased Strategies

Many hotel groups find success with hybrid approaches that combine vendor platforms with custom extensions. This strategy leverages vendor core functionality while developing proprietary features for competitive differentiation. APIs and webhooks enable custom integrations that preserve unique operational workflows while benefiting from vendor-maintained infrastructure.

Phased implementation strategies reduce risk while validating approach effectiveness. Begin with vendor solutions for standardized processes like payment processing and document verification, then evaluate custom development for differentiating features. This approach provides immediate operational improvements while preserving flexibility for future customization.

Consider starting with pilot deployments at select properties to establish baseline metrics and refine requirements. Las Vegas Sands’ biometric check-in pilot demonstrates how controlled testing can validate technology effectiveness before portfolio-wide rollout. Measure guest adoption rates, operational efficiency gains, and staff satisfaction to inform broader deployment decisions.

Implementation Roadmap and Change Management

Phase 1: Foundation and Pilot Selection (Months 1-2)

Successful automation initiatives begin with comprehensive baseline measurement and pilot property selection. Audit current front desk metrics including average check-in time, payment processing duration, and documentation completion rates. Map compliance requirements across all operating jurisdictions to identify automation priorities. These metrics provide quantifiable targets for improvement and ROI calculation.

Select 2-3 pilot properties representing different segments of your portfolio —urban business hotels, resort properties, and extended-stay locations face different operational challenges requiring varied automation approaches. Pilot properties should have strong operational leadership committed to transformation and sufficient IT infrastructure to support new technologies.

Establish success criteria before deployment, including target adoption rates (40% pre-arrival, 100% assisted digital), operational metrics (65% queue time reduction), and financial objectives (ROI within 12 months). Create feedback mechanisms to capture guest and staff input throughout the pilot phase.

Phase 2: Technical Integration and Testing (Months 3-4)

Technical integration represents the highest risk phase requiring careful project management. Begin with PMS API configuration and testing, ensuring real-time data synchronization for room assignments, guest profiles, and payment status. Payment gateway setup and certification follows, with particular attention to PSD2 compliance requirements for European properties.

Document template customization ensures compliance with local regulations while maintaining brand standards. Digital guest forms for traveler registration, consent, and data privacy must be configured for each jurisdiction. Test workflows for edge cases including group bookings, extended stays, and special requirements to identify integration gaps before broader deployment.

Conduct thorough security assessment including penetration testing and compliance validation. With regulatory penalties for data breaches increasing, comprehensive security validation proves essential. Ensure solutions meet GDPR requirements for data portability and guest rights management.

Phase 3: Scaled Deployment and Optimization (Months 5-12)

Regional deployment waves based on complexity enable systematic rollout while maintaining service quality. Begin with properties sharing similar PMS platforms and operational models, then expand to more complex locations. This approach allows refinement of training materials and support processes based on early deployment experiences.

Continuous training programs prove essential for sustained adoption. Staff training should emphasize technology as an enabler rather than replacement, focusing on how digital tools free time for meaningful guest interactions. Properties report 34% improvement in staff satisfaction when digital workflows eliminate repetitive tasks. Create certification programs with performance-based incentives to drive engagement.

Monitor performance metrics continuously and iterate based on results. Track assisted versus self-service ratios to identify patterns informing service design. Properties successfully achieving 40% self-service, 35% assisted digital, and 25% traditional check-in within six months should share best practices across the portfolio. Continuous optimization based on guest feedback and operational metrics drives adoption improvement of 15-20% monthly during the first year.

Measuring Success: KPIs and ROI Framework

Operational Efficiency Metrics

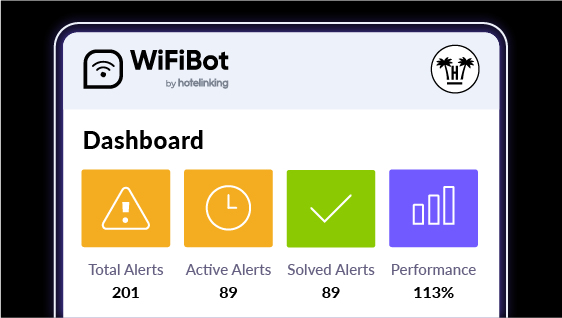

Queue time reduction serves as the primary operational metric, with successful implementations achieving 65% decrease in average wait time. Measure check-in duration from guest arrival to room key delivery, tracking both digital and traditional processes. Properties reducing average check-in time from 8 minutes to 2.5 minutes through tablet-based assisted check-in demonstrate the potential for dramatic improvement.

Digital adoption rates indicate guest acceptance and staff effectiveness. Target 40-60% pre-arrival completion for direct bookings, with higher rates for loyalty members and business travelers. Assisted digital check-in should achieve 100% coverage for guests not completing pre-arrival processes. Track adoption trends by segment, property type, and booking channel to identify optimization opportunities.

Payment automation metrics reveal financial process efficiency. Successful implementations process 95% of transactions without manual intervention, reducing payment disputes by 73%. Monitor pre-authorization success rates, tourist tax collection accuracy, and chargeback frequency. Automated systems should achieve 100% documentation completion with zero regulatory violations.

Financial Impact Assessment

Direct cost savings manifest through labor reallocation, with properties typically reassigning 2-3 FTE positions from transactional tasks to guest service roles. This redeployment improves service quality while reducing operational costs by €120,000-€180,000 annually per property. Calculate actual savings based on local labor costs and redeployment opportunities.

Revenue assurance through reduced walkouts and payment failures adds significant value. Automated pre-arrival check-in reduces no-show rates by 12% through improved guest engagement. Real-time payment verification prevents revenue leakage from failed authorizations, with properties reporting €200,000-€400,000 in recovered revenue annually. Track revenue metrics including ADR impact, upsell conversion, and ancillary spending.

Guest satisfaction improvements drive long-term financial benefits. Hotels achieving 60% or higher digital check-in adoption report NPS scores 15-20 points higher than properties with manual processes. Review scores improve by 0.3-0.5 points on average, directly impacting booking conversion rates. Calculate the lifetime value impact of improved guest satisfaction to justify continued investment.

Action Items for Q4 2025 and 2026

The window for competitive advantage through front desk automation is closing rapidly. With 70% of travelers preferring digital check-in options and major chains achieving 60-89% automation rates, properties maintaining manual processes risk obsolescence. Hotel groups must act decisively to capture operational efficiencies and meet evolving guest expectations.

First, conduct comprehensive assessment of your current operational state.

- Measure front desk time allocation, quantifying hours spent on manual data entry, payment processing, and compliance documentation.

- Identify your highest-friction touchpoints where automation would deliver immediate impact. This baseline enables accurate ROI projection and success measurement.

Second, evaluate your technical readiness for automation.

Assess PMS capabilities across your portfolio, identifying properties requiring infrastructure upgrades. Review payment gateway architecture to ensure PSD2 compliance and multi-currency support. Document integration requirements for existing systems including CRM, revenue management, and loyalty platforms.

Third, initiate vendor evaluation or build feasibility analysis based on your strategic priorities.

If pursuing vendor solutions, develop RFP criteria emphasizing integration capabilities, scalability, and total cost of ownership rather than feature checklists. If considering custom development, realistically assess internal technical capabilities and long-term resource commitment required for success.

The hotel groups achieving operational excellence through front desk automation aren’t waiting for perfect solutions or universal guest acceptance.

They’re implementing systematic approaches that balance efficiency with hospitality, using technology to eliminate friction while preserving human connections. The capabilities exist today—from AI-powered document verification to multi-gateway payment orchestration. The question is whether your organization will lead or follow the operational transformation reshaping hospitality.