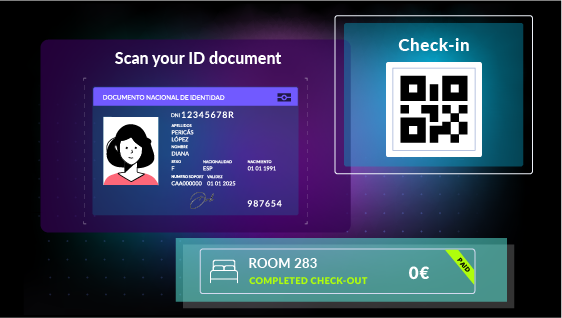

Reduce check-in delays by automating transactions, letting staff focus on service instead of payments.

Digital Payments for a Frictionless Hotel Experience

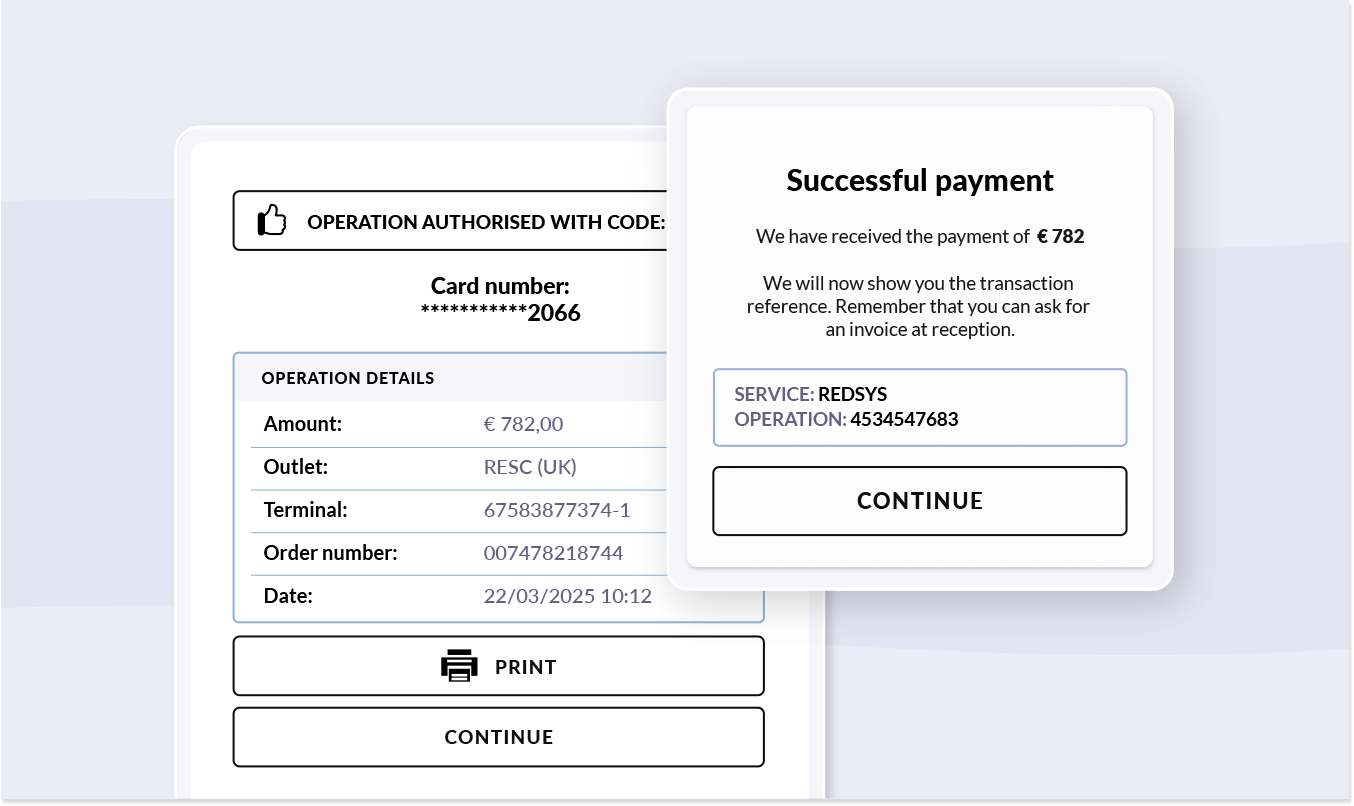

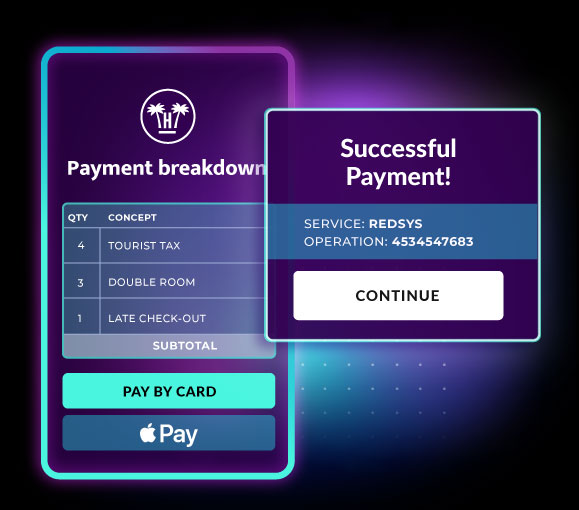

Secure credit card authorizations, process pre-arrival payments, and settle charges at check-in or check-out—fully automated and integrated with your PMS.

Front desk teams waste hours manually processing payments, leading to long check-in lines and guest frustration.

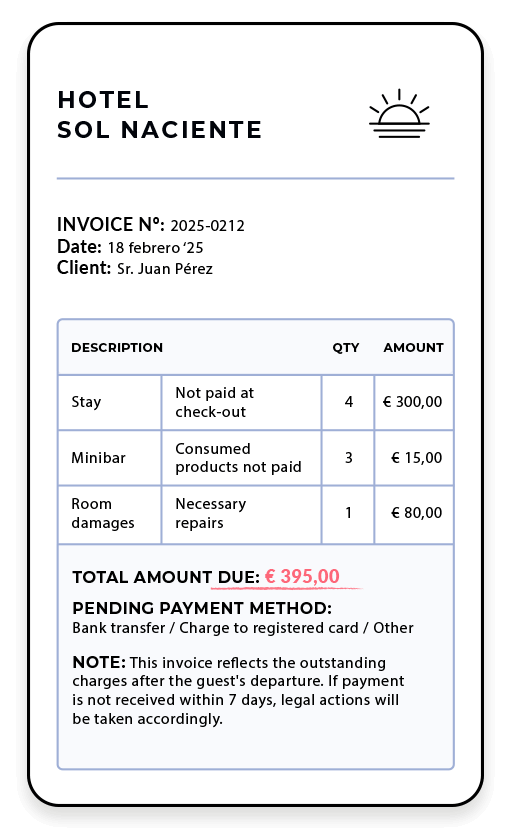

Hotels risk financial losses due to unpaid bills and damages when guests leave without settling outstanding charges.

Manual payment handling delays check-out, causing guest dissatisfaction and negative online reviews for the hotel.

Without automated credit card pre-authorizations, hotels lack payment guarantees, increasing chargeback disputes.

Operations Department

Fast, Secure, and Automated Hotel Payments

Process transactions instantly, protect against chargebacks, and free staff from manual payment tasks.

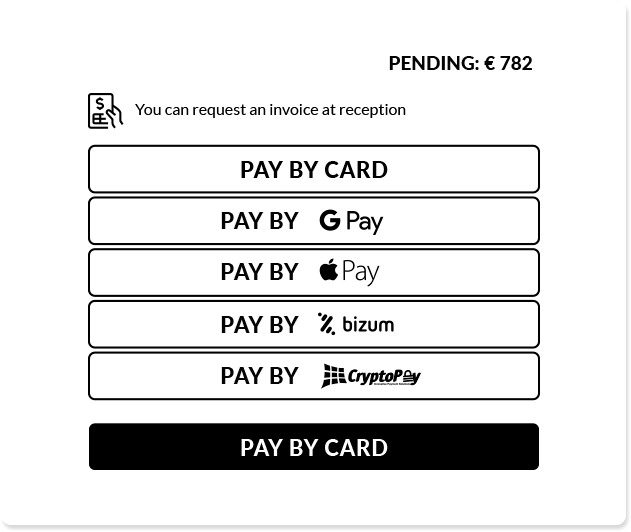

Turn Your Front Desk Cashless and Digital

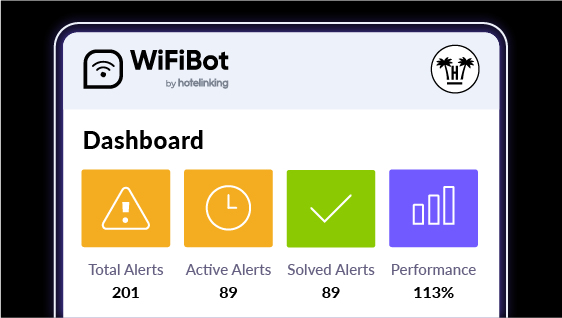

Automated Hotel Payments with PMS & Gateway Integration

Sync payments in real-time, detect prepaid bookings, and process transactions effortlessly with full PMS and multi-gateway support.

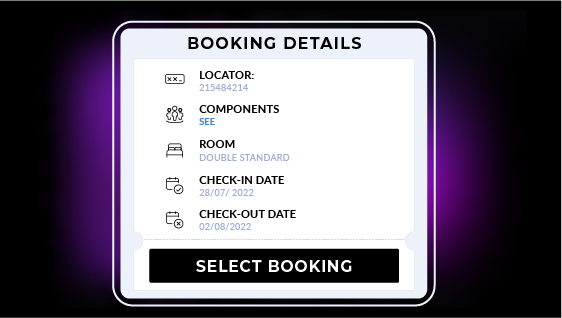

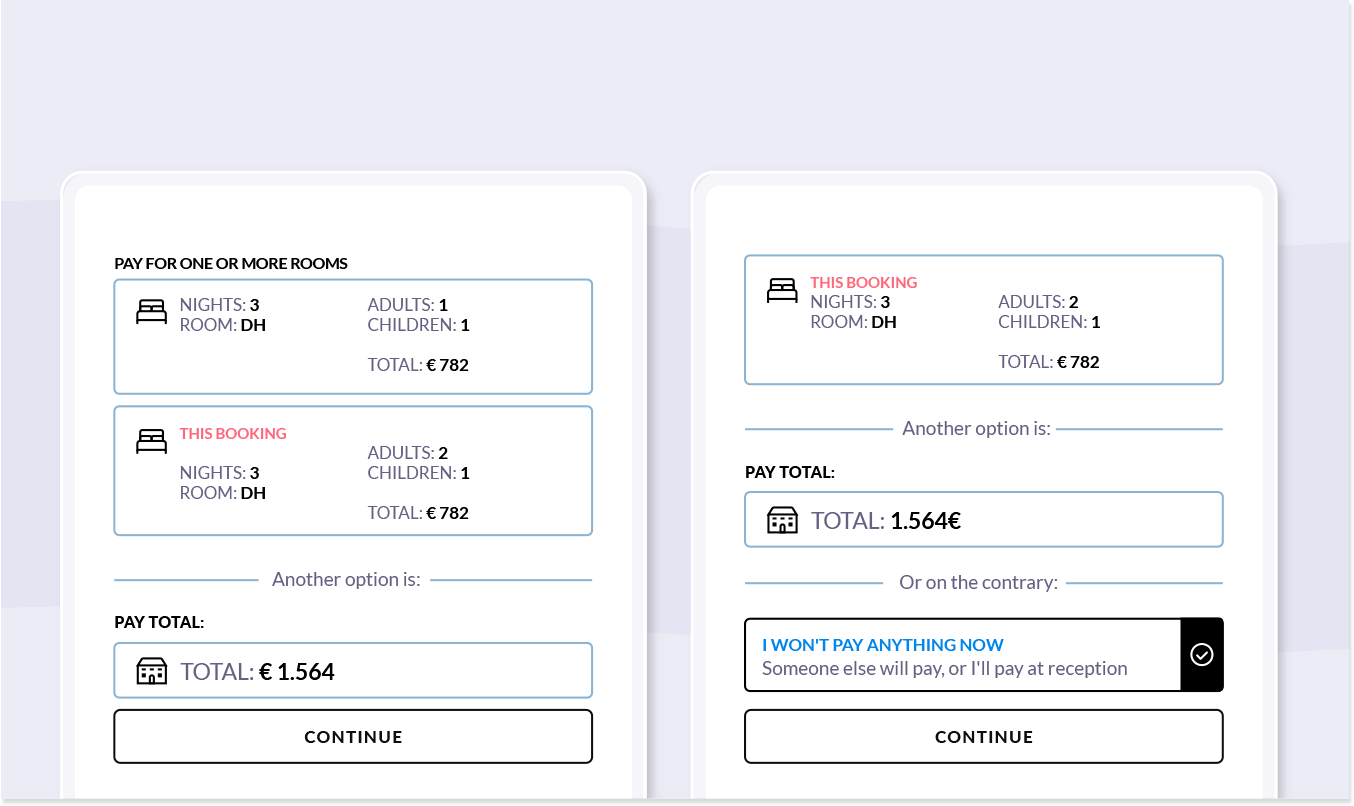

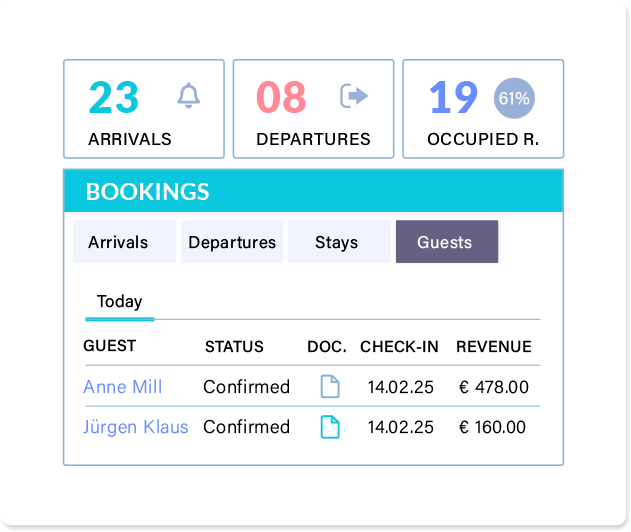

Real-Time PMS Integration for Automated Payments

Integrates with PMS to retrieve balances, process payments, and update guest accounts in real-time with zero manual work.

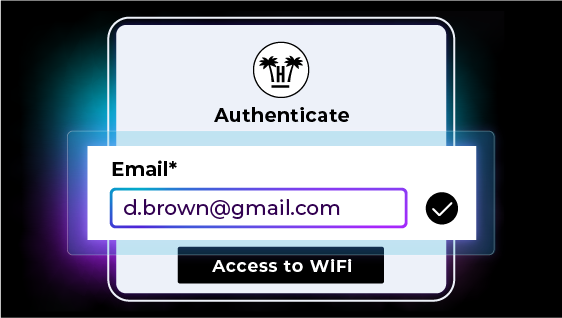

Multi-Gateway Compatibility for Maximum Flexibility

Multi-gateway support enables hotels to accept various payment methods, ensuring compliance while reducing processing complexities.

Smart PMS Sync to Detect and Skip Prepaid Bookings

Prepaid bookings from OTAs and TTOOs are instantly detected via PMS, skipping redundant payment steps for a fully automated flow.

From Transaction to Experience—Redefining Hotel Payments

Digital payments remove friction, speed up check-in, and let your staff focus on hospitality, not handling credit cards.